11/10/2025

Angola: Block 6/24 – New concession

Rui Amendoeira

A new concession for Block 6/24 has been awarded by way of Presidential Decree 177/25, of 8 October 2025. Block 6/24 is located in the Kwanza offshore basin.

The concession was awarded to a consortium comprised of the following companies:

- Sonangol – Exploração e Produção, S.A. (Operator) – 50%

- Redsky Angola Limited – 35%

- ACREP, S.A. – 15%

A Risk Service Contract was signed between the above companies.

The Exploration Phase will have a duration of 6 years from the signing of the RSC, and the Production Phase for each Development Area a duration of 30 years from the respective Declaration of Commercial Discovery.

A 30% Investment Premium was set on all capital expenditures incurred in each tax year from commencement of production.

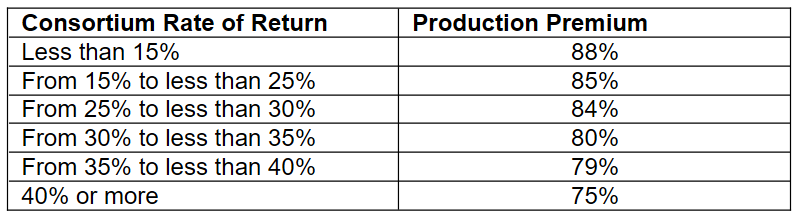

A Production Premium was set as follows: