13/10/2025

Angola: Block 3/24 – New concession

Rui Amendoeira

A new concession for Block 3/24 has been awarded by way of Presidential Decree 178/25, of 8 October 2025. Block 3/24 is located in the Lower Congo basin shallow waters.

The concession was awarded to a consortium comprised of the following companies:

- Afentra (Operator) – 40%

- Maurel & Prom – 40%

- Sonangol, E&P – 20%

A Risk Service Contract was signed between the above companies.

The Exploration Phase will have a duration of 5 years from the signing of the RSC, and the Production Phase for each Development Area a duration of 25 years from the respective Declaration of Commercial Discovery.

A 30% Investment Premium was set on all capital expenditures incurred in each tax year from commencement of production.

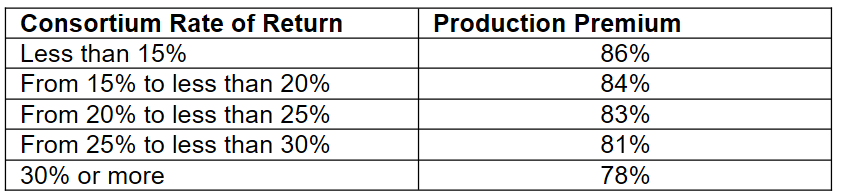

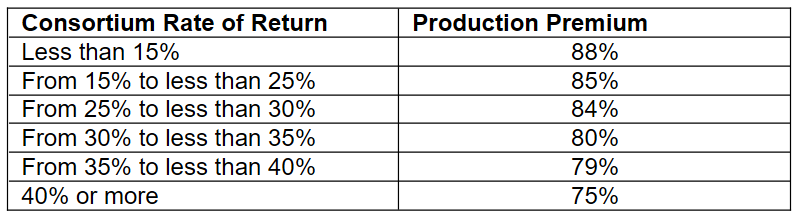

A Production Premium was set as follows: